Hyperinflation is a term used in economics to describe extremely high and often rising inflation. As the actual value of the local currency rises, so do the prices of all commodities.

Hyperinflation, in contrast to modest inflation, is characterized by a rapid and continuous rise in nominal prices that is not readily apparent until prior market prices are studied. The overall price level grows at a rate that is even faster than the money supply.

Government budget shortfalls fueled by currency creation have produced nearly all hyperinflations. The government’s ability to collect tax income is being hampered by crises.

Economists commonly adopt Cagan’s definition of hyperinflation, which is defined as a monthly inflation rate of more than 50%.

What caused Hyperinflation?

Government budget shortfalls fueled by currency creation have produced nearly all hyperinflations. hyperinflation happens when the amount of money continues to rise rapidly without being matched by an increase in the output of goods and services.

The price rises that might occur as a result of fast money production can become a vicious spiral. As a result, both monetary and price inflation are accelerating rapidly.

The local people are increasingly hesitant to keep the local money due to quickly rising prices.They spend whatever money they receive rapidly, increasing the velocity of money flow, which drives prices to rise even faster.

Monetary inflation is a flat levy on creditors that also redistributes to private borrowers proportionally.

Example of hyperinflation

Theories of hyperinflation generally look for a relationship between the difference between the value of money and the cost to produce and distribute. In countries experiencing hyperinflation, the central bank often prints money in larger and larger denominations as the smaller notes become worthless.

- Germany (weimar republic ) 1922

Between 1921 and 1923, hyperinflation afflicted the German Papiermark, the Weimar Republic’s currency, particularly in 1923. It caused damage to the country’s internal political situation.

November 1923, one US dollar was worth 4,210,500,000,000 German marks according to the “Western Civilizations” of Coffin.

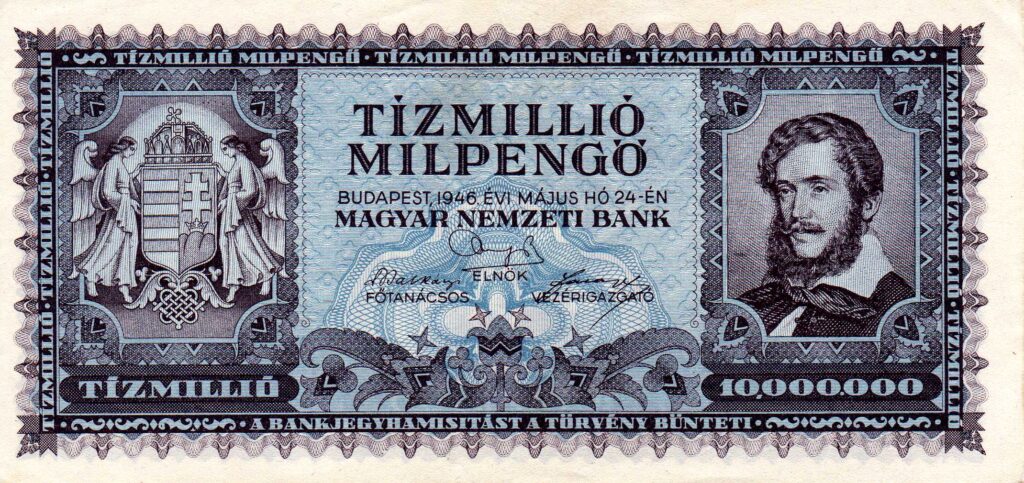

- Hungary 1945

The Hungarian participle pengő After World War II, the pengo’s value plummeted,with the greatest rate of hyperinflation ever recorded.

There were various attempts to slow it down, including a 75% reduction in speed. However this did not stop the hyperinflation, and prices continued spiralling out of control.

- Yugoslavia 1992

Before and during Yugoslavia’s disintegration, from 1989 to 1991.

The Federal Republic of Yugoslavia, one of its successor republics, underwent a period of hyperinflation in April 1992.

Until 1994, it was the case. One new dinar was swapped for 10,000 old dinars at the 1990 currency reform.

One new dinar was exchanged for 1,000,000,000 old dinars at the 1994 currency reform. A month later, 1 Novi dinar was exchanged for 13 million dinars in another currency reform (1 Novi dinar = 1 German mark at the moment of exchange).

Overall, hyperinflation caused 1 Novi dinar to be worth 1 1027 – 1.3 1027 pre-1990 dinars.

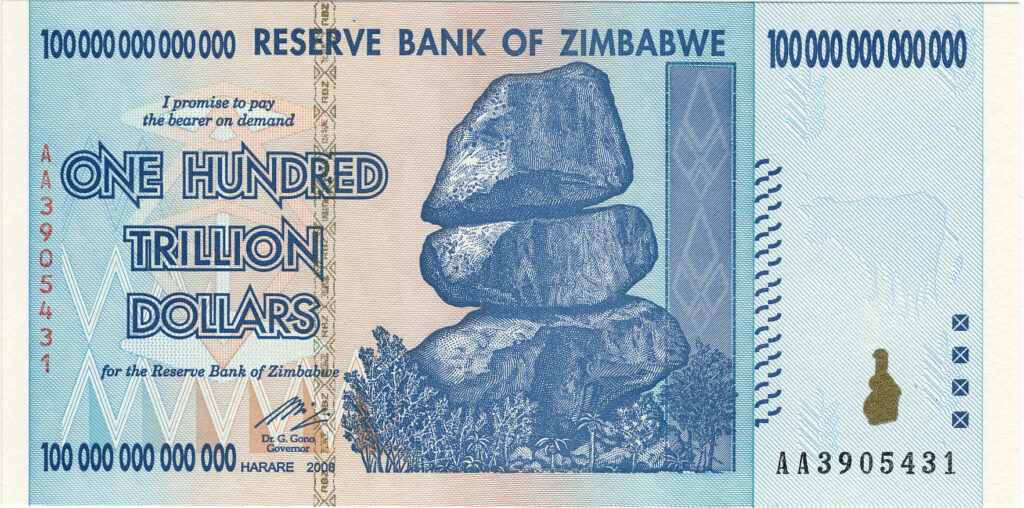

- Zimbabwe 2007

Hyperinflation in Zimbabwe was a period of currency instability in Zimbabwe.According to the web archive.

In February of that year Because the Zimbabwean government stopped publishing official inflation numbers during the peak of hyperinflation in 2008 and 2009, measuring Zimbabwe’s hyperinflation proved impossible.

In mid-November 2008, Zimbabwe’s peak month of inflation was reported to be 79.6 billion per cent month-on-month and 89.7 sextillions per cent year-on-year.

- Venezuela 2016

The hyperinflation in Venezuela began in November 2016. Venezuela’s bolivar Fuerte (VEF) saw the world’s highest inflation rate of 69 per cent in 2014. Inflation reached 181per cent in 2015, the biggest in the country’s history at the time, 800 per cent in 2016, over 4,000 per cent in 2017, and 1,698,488 per cent in 2018, sending Venezuela into hyperinflation.

Hyperinflation can take virtually your entire life savings, without the government having to bother raising the official tax rate at all. “Thomas Sowell”