A form of currency known as fiat money is one that is not backed by any physical good, like gold or silver. Usually, the government declares something to be legal tender through a decree. Fiat money has occasionally been created throughout history by regional banks and other organizations. Fiat money is typically created by government regulation today. Fiat money is an essentially worthless item or record that is extensively used as a form of payment in monetary economics.

Fiat currencies will eventually disappear and be replaced by digital ones. Banks and traditional finance are forced to embrace change and get ready for it. The mortgage crisis of 2007 and the ensuing financial collapse, for instance, dispelled the notion that controlling the money supply by central banks would automatically prevent depressions or severe recessions. In order to protect fiat currency from inflation, cryptocurrency coins were created without any tendency toward inflation.

Disadvantages Of fiat money

- Gives central banks greater control over the economy

- The difference between a currency’s value and its production and distribution costs. the fee that was imposed on the total cost of a coin before it was paid for by a consumer and transmitted to the political region’s ruler. Money creation, another form of governmental income, is obtained by systematic debt monetization, which also involves raising the money supply in response to GDP expansion and hitting inflation targets on a yearly basis.

- Possibility of a bubble.

- Inflation

Due to these drawbacks of the fiat currency, we have seen hyperinflation throughout history, which causes an economic collapse and renders the fiat currency useless. Examples of hyperinflation are shown here.

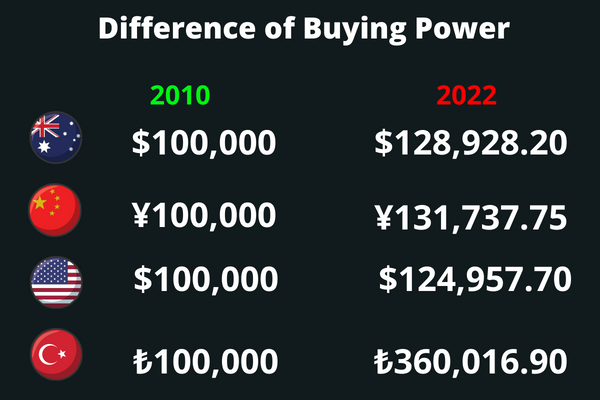

Buying power

The buying power of fiat money is decreasing every year. This is because the money is losing its value due to inflation. When this happens, the money you have loses its purchasing power. For example, if the inflation rate is 3%, then a $100 bill will only be worth $97 in a year. This decrease in purchasing power is a big problem for savers and retirees.

It’s also a problem for anyone on a fixed income, such as Social Security or pension payments. And it’s a problem for the economy as a whole because it makes it harder for people to save money and invest in the future. There are a few ways to combat the effects of inflation. One is to invest in assets that increase in value faster than the rate of inflation. Another

Fiat money is a currency that is not backed by a physical commodity. It is used as legal tender and its value is based on the faith and credit of the issuing government. Over time, the buying power of fiat money decreases due to inflation. This is because there is more fiat money in circulation, and each unit of currency is worth less than it was before.

In order to combat the effects of inflation, central banks can adjust interest rates. This encourages people to save rather than spend, which reduces the amount of fiat money in circulation and helps to stabilize its value. In the long run, however, the purchasing power of fiat money will continue to decrease as the supply of it increases.

Conclusion

In conclusion, it is evident that fiat money is no longer a viable solution for the global economy. With the advent of digital currencies, there is now a better alternative that is more efficient, transparent, and secure. While fiat money will still be used in the short term, it is only a matter of time before it is fully replaced by digital currencies.

The end of fiat money