Terra is deploying a suite of algorithmic decentralized stablecoins to the world it has been seen as a Ponzi scheme with 3 relevant pieces.

1. Luna

2. Ust

3. Anc

The relation between luna and the UST. The UST is a stable coin so its aim is to maintain a $ 1 peg and there something making it special is that it is not backed by anything like another stable coin. The UST relied on arbitrage and market incentive to maintain its pegs it does so by working with luna.

How does it work?

There is 2 way to own a UST coin is to buy from an exchange or use the mint and burn mechanism because this how the exchange between UST and Luna work to burn USD 1 with luna and the protocol would mint UST and the reverse is possible all this is done regardless of the UST price in the market.

This result is 2 options to buy UST:

1. Buy on exchanges

2. Use mint and burn mechanism

The UST is sometimes over $1 or under $1. Due to the volatility of the UST even though it was supposed to be a stable coin all this happened because the demand for UST fluctuated.

In the case of UST being over $1:

when the UST is over USD 1, let us assume it is UST =$1.09 and an investor has 1 Luna, and let us also assume the price of luna is USD 100.

If the investor wants to swap from Luna to UST he will burn his LUNA. This comes with the result of him burning USD 100 LUNA and selling his UST

to the other stablecoin where he would generate USD 109 of UST because UST =$1.09.Where he will make a $9 profit.

And people would repeat the process over and over and this arbitrage process increases the supply of UST and decreases the supply of LUNA because people are burning LUNA and the system mints UST so they can sell and make more profit.

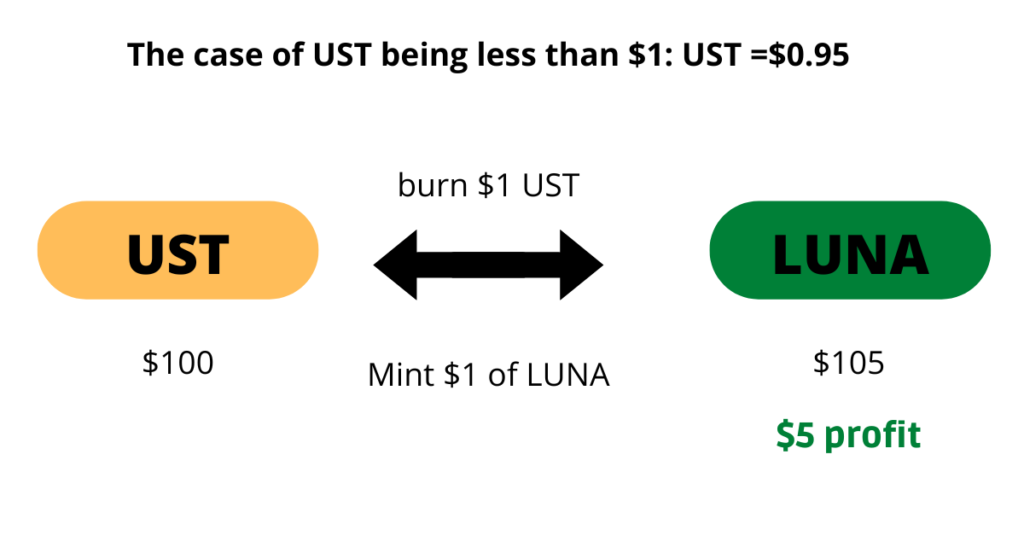

The case of UST being less than $1:

The same things happened but this time people would buy UST and burn it and sell their LUNA on the outside exchange so they can still make a profit, and this time the price of UST would go back to $1. All this happened to UST is an algorithmic stable coin.

ANCHOR PROTOCOL

If you remember we have also an anchor(ANC) in the list. It is the main landing for terra protocol is also the main key for this whole Ponzi a scheme by offering approximately 20% APY which is very high that directly attracts people to buy more UST which somehow deeply related to LUNA, in a very simple we have this equation:

anchor costs = deposit UST *20% APY that make people buy UST.